Stock trading isn’t just something you do on the side anymore. More people are profiting from market performance than ever, and with the success of new apps like Robinhood, investing is easier than ever before. But if you want to become a full-time trader in Singapore, there are some things you need to know.

We’re not going to lie; becoming a full-time stock trader won’t be easy. You will have to learn how to manage your money quickly and accurately while also maintaining an advantage over the competition to turn a profit. If that sounds stressful, don’t worry – it can be done in five easy steps!

5 Ways To Become A Full-Time Stock Trader in Singapore. Continue Reading Below.

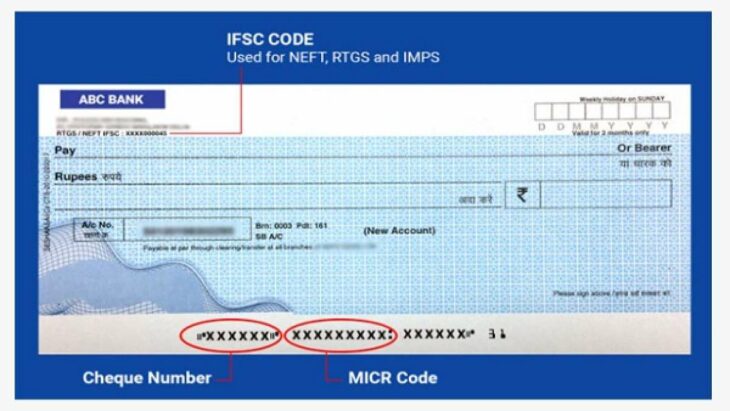

Open an Investment Account

The first thing you’re going to need before starting trading is a brokerage trading account. Make sure that it’s a US account because some Asian countries have restrictions on certain trading accounts. It will allow you to trade global markets, which means more potential for profits!

Start Learning

To become a full-time stock trader in Singapore, you’ll have to learn the tricks of the trade from somewhere. Luckily there are numerous websites and apps available for no charge whatsoever – make sure they’re credible sources! Once you’ve got your new streaming chart set up on Google Finance or Yahoo! Finance, bookmark these four pages immediately: Investopedia StockCharts Yahoo! Finance eTrade To start, read through these pages daily to get an idea of how the market works.

Set Realistic Goals

Now that you’ve got yourself set up, it’s time to make some money! Before you can do that, you will need to establish your goals. It is essential because it will keep you motivated when you don’t feel like trading – which will happen at first. If your goals are too high, this could discourage you from continuing altogether. If they’re too low, it’s no challenge and therefore no fun! Make sure your goals are realistic so that you can reach them within a reasonable time frame (weeks or months). Setting up daily/weekly/monthly targets will give you something to aim for and indicate when you’ve reached your goal.

Set Up a Trading Routine

There’s no doubt about it: becoming a full-time stock trader in Singapore takes up a lot of time. You’ll have to make sure that you dedicate an hour or two every day to learning more about the market, studying charts and doing research on the companies whose stocks you’re interested in buying. Once you start putting money into your account, managing it will take even more time away from your workday – which is why we recommend setting up a routine! You can trade before work, after work or during lunch breaks – whatever works best with your schedule. Make sure that once this becomes part of your daily life, you don’t skip a day, though – this is how you’ll become a full-time stock trader!

Find the Best Trading App for You

There are mutual apps that claim to make trading stocks simple and easy. In most cases, they’re not wrong – but most of these apps have high fees, which can eat away at your profits.

Please don’t waste your time with expensive streaming charts and extra widgets unless necessary (maybe you need news feeds or stock alerts). Many people like Saxo Bank because it has no fees and makes buying/selling as easy as possible, but we also recommend checking out Day Trade to Win. This site uses technical analysis tips to keep track of market trends and tell you when to buy/sell for maximum profits.

Learn everything you need to know about being a full-time stock trader in Singapore by following this link and clicking for more info.

You must be logged in to post a comment.